Atlanta Hard Money Lenders Can Be Fun For Anyone

Wiki Article

The Ultimate Guide To Atlanta Hard Money Lenders

Table of ContentsOur Atlanta Hard Money Lenders IdeasThe Ultimate Guide To Atlanta Hard Money LendersIndicators on Atlanta Hard Money Lenders You Need To KnowThe Best Guide To Atlanta Hard Money Lenders5 Easy Facts About Atlanta Hard Money Lenders DescribedThe smart Trick of Atlanta Hard Money Lenders That Nobody is Talking About

In a lot of cases the approval for the hard cash lending can happen in just someday. The tough cash lending institution is mosting likely to think about the building, the quantity of down repayment or equity the borrower will certainly have in the home, the debtor's experience (if applicable), the leave approach for the residential property as well as ensure the consumer has some money reserves in order to make the month-to-month loan payments.Investor that haven't previously used hard money will certainly be surprised at just how rapidly hard cash fundings are funded contrasted to banks. Contrast that with 30+ days it considers a financial institution to fund. This speedy financing has saved many investor that have remained in escrow only to have their initial lending institution take out or simply not deliver.

Their list of needs enhances each year as well as several of them appear arbitrary. Financial institutions additionally have a list of concerns that will certainly elevate a red flag and also avoid them from also considering providing to a consumer such as current repossessions, brief sales, finance alterations, and insolvencies. Negative credit report is an additional variable that will protect against a bank from providing to a borrower.

The Main Principles Of Atlanta Hard Money Lenders

The good news is genuine estate financiers that might presently have a few of these issues on their record, hard cash lending institutions are still able to provide to them. The difficult cash lending institutions can provide to borrowers with concerns as long as the consumer has sufficient deposit or equity (a minimum of 25-30%) in the building.When it comes to a possible consumer that wishes to buy a main residence with an owner-occupied difficult cash financing through a private mortgage loan provider, the borrower can originally acquire a residential property with tough money and afterwards work to repair any kind of concerns or wait the needed quantity of time to remove the issues.

Financial institutions are likewise unwilling to give mortgage to consumers that are self-employed or currently lack the called for 2 years of work background at their present placement. The customers may be an ideal prospect for the loan in every various other facet, however these arbitrary needs protect against financial institutions from prolonging financing to the debtors.

The Buzz on Atlanta Hard Money Lenders

When it comes to the consumer without enough employment history, they would have the ability to refinance out of the tough cash car loan and also right into a lower price traditional financing once they acquired the required 2 years at their present placement. Hard money lending institutions offer lots of lendings that standard loan providers such as banks have no interest in financing.

These projects involve an investor acquiring a residential or commercial property with a short-term financing to make sure that the investor can quickly make the required fixings and updates and after that market the home. atlanta hard money lenders. The actual estate financier just requires a 12 month funding. Banks want to lend money for the long-term and enjoy to make a tiny quantity of interest over a lengthy period of time.

The problems could be connected to foundation, electrical or plumbing and also could cause the bank to consider the home uninhabitable and also not able to be funded. and also are not able to take into consideration a loan situation that is outside of their stringent loaning criteria. A difficult money lending institution would certainly be able to provide a customer with a loan to acquire a building that has concerns stopping it from receiving a traditional financial institution finance.

The Best Strategy To Use For Atlanta Hard Money Lenders

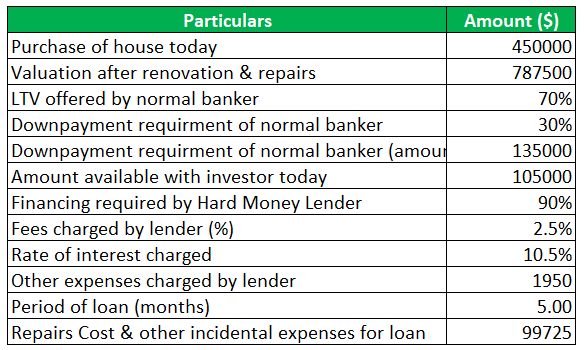

Hard money lending institutions likewise charge a funding source cost which are called factors, a percent of the funding amount. atlanta hard money lenders. Points generally vary from 2-4 although there are loan providers that will certainly bill much higher factors for specific situations. Specific locations of the country have several competing difficult money loan providers while various other locations have couple of.

In big urbane areas there are generally much more difficult money loan providers ready to provide than in farther backwoods. Borrowers can profit substantially from examining rates at a couple of different lending institutions prior to dedicating to a difficult cash lending institution. While not all difficult cash lenders use 2nd home loans or trust deeds on residential or commercial properties, the ones that do charge a greater interest rate on 2nds than on 1sts.

What Does Atlanta Hard Money Lenders Do?

This enhanced rates of interest shows the increased danger for the loan provider being in 2nd position as opposed to 1st. If the customer enters into default, the first lien holder can foreclose on the property and clean out the 2nd lien owner's rate of interest in the residential or commercial property. Longer terms of 3-5 years are available but that is generally the top restriction for loan term size.If interest rates go down, the consumer has the alternative of refinancing to the reduced current rates. If the rate of interest increase, the debtor is able to keep their lower rate of interest car loan and loan provider is required to wait until the funding comes to be due. While the lending institution is waiting on the loan to end up being due, their financial Get the facts investment in the trust fund deed is generating less than what they might obtain for a brand-new trust fund deed financial investment at current prices.

:max_bytes(150000):strip_icc()/hard-money-basics-315413_Final-cdfb8155170c4becb112da91bd673fe8-0472b1f57ff94abebddef246c221a65f.jpg)

Atlanta Hard Money Lenders for Beginners

This is a worst instance circumstance for the hard money lending institution. In a comparable scenario where the consumer check out here places in a 30% down payment (rather than only 5%), a 10% decline in the value of the home still provides the debtor lots of reward to stick with the residential or commercial property and also project to secure their equity.Report this wiki page